While the average ROI for a U.S. rental property is 10.6%, you also have to account for income taxes. Being a landlord is just like any other job, which means it is taxable.

If you are wondering how to report your income for your rental properties it can be somewhat confusing.

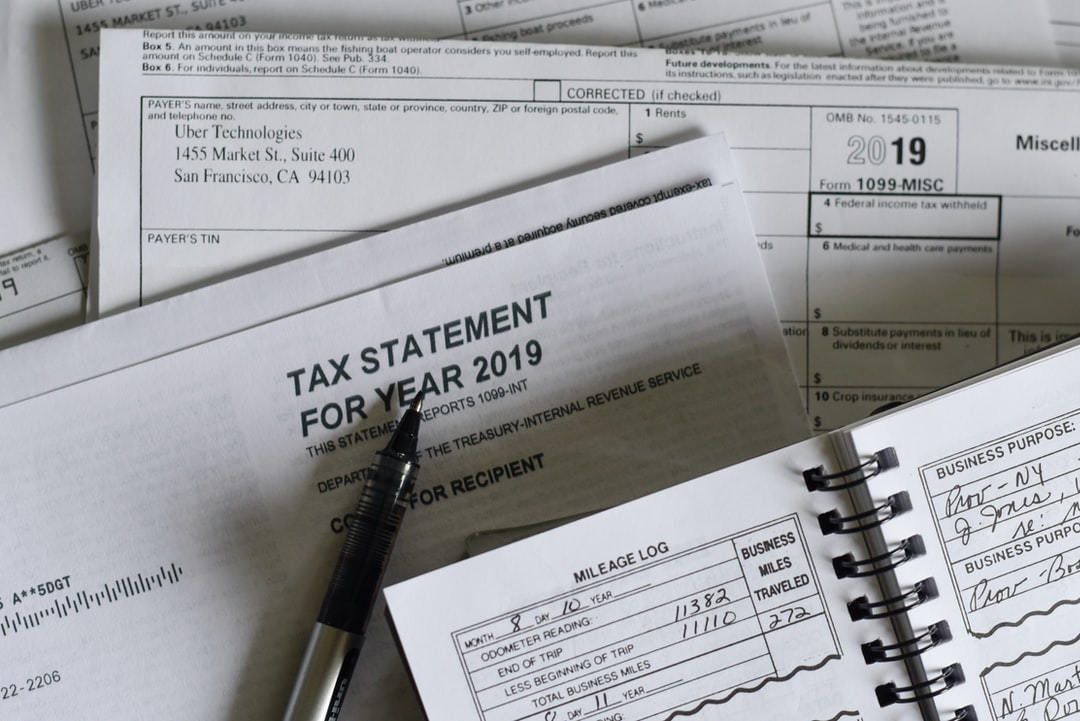

Use this guide to meet the 1099 requirements for landlords.

What is a 1099 Form?

A 1099 form is the standard filing method for people who are self-employed. This includes contractors, businesses under a self-proprietorship and, of course, landlords.

This method of income reporting differs from the traditional W2 form used when you receive a salary from an employer. Instead, use a 1099 form to report your income. In this case, you need to complete a 1099 for all your properties.

Types of 1099 Forms

There are many types of 1099 forms, but for landlords, there are two main forms typically used for rental properties. You may only use one or both of the following forms:

- 1099 MISC Form - Used to report income from rental properties

- 1099 NEC Form - Used to send to contractors that performed a service for your rental property

If you have a commercial property, then the tenants from this type of rental need to give you a 1099 MISC form. If you use property managers for your commercial property, then you need to give them a 1099 NEC form.

Landlord 1099 Requirements

How do you know if your rent income requires a 1099?

First, you have to determine if you are a real estate professional. You must meet the following requirements to be considered a real estate professional:

- Rent or lease property and receive money in return of at least $600 per year from an individual or commercial business.

- Over half of all your business services within a tax year go towards the business of renting/leasing real estate from which you receive payments.

- You have performed over 750 hours of services within the tax year towards real estate activities from which you received payments from.

If you own several rental properties, then you can use the time spent on all of them to meet the 750 hours.

Completing a 1099 Form

During tax filing season, you can find the 1099 form on the IRS website which walks you through the process. However, if you don't have your paperwork in order or if you don't know how rental income is taxed, then completing this document can be difficult.

Keep records of all your rental payments and invoices for services conducted at your property.

You also need to know if any contractors are exempt from 1099. You can find this answer by looking at their W9 form. If they are exempt, then keep the W9 for your records. For those contractors who aren't exempt, use the information on the W9 to complete a 1099 form to send them the form.

Get Help With Your 1099 Form

Managing a property is difficult on its own, but filing taxes for your property by knowing the 1099 requirements can seem impossible if you haven't done so before. Luckily, there are ways to do both by preparing your property and income taxes all year.

At Harland Property Management, we help you with property accounting to ensure you get the best ROI and that you file your taxes accurately. Contact us today to speak with a representative.